GovTech is a term that has seen an increase in popularity in recent years as countries around the world have pursued a multitude of GovTech strategies. This blogpost gives an introduction to GovTech and an overview on the French GovTech strategy. A second blogpost will follow that analyses the German GovTech strategy in contrast and gives overall recommendations for national GovTech strategies.

As part of the Hertie School MPP class of 2022, the author wrote her master’s thesis entitled “Fostering Collaboration of GovTech startups and the Public Sector in the context of digitalization – A comparison of the French and German approach”. The thesis sought to find out how much the French and German GovTech ecosystems differ from each other and to discern how well the GovTech strategies and collaboration between GovTech startups and the public sector in both countries work.

What does GovTech mean?

First and foremost, it is important to understand that GovTech does not yet have a standardised definition but leaves room for interpretation and is used differently by researchers in different contexts. For the following analysis we will stick to this definition:

“GovTech refers to the process of making government technology more modern, intuitive and user-friendly: more in line with the technology we use in consumer and business sectors. Another way to describe it is to say that GovTech brings a start-up ethos to solving public problems and delivering public services.”

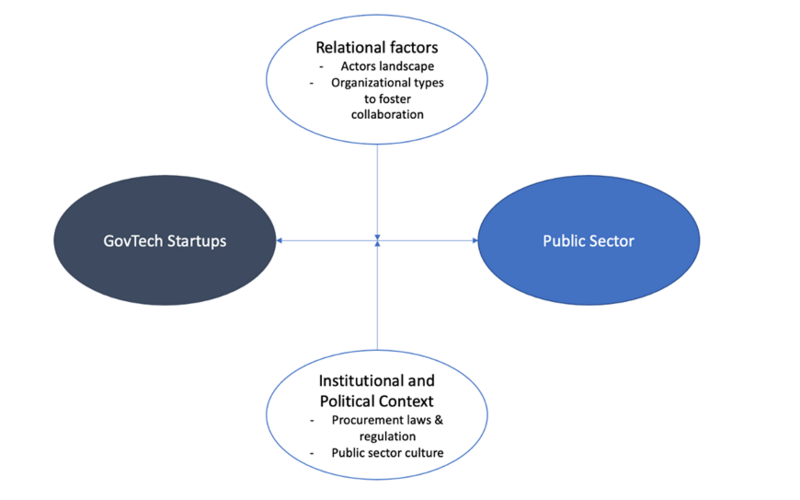

The global market size of GovTech was estimated to be 411 billion euros in 2021 and is expected to continue growing. Of that total, the European market accounts for 116 billion euros. A closer look at the numbers shows that the European GovTech market is dynamic but still highly fragmented, as not all countries have achieved the same level of digitisation. By sheer market size, France and Germany are the largest players on the European level. For that reason, these two countries were chosen for the comparative analysis of this thesis and blogposts. Through an extensive literature review, it was determined which factors impact the relationship between GovTech startups and the public sector most in France and Germany. What can be seen is that both relational factors and the institutional and political environments impact this relationship, from which the following conceptual framework was derived:

Relational factors are mainly about the actors at play e.g., which actors are there in the field, how committed are they to driving forward GovTech matters, etc. Another driver of relational factors is the presence of organisational types that foster collaboration, as seen in Filer’s analysis of GovTech for policymakers. Filer claims that ideas can be generated through eight different organisational types, including amongst others government challenge programmes, public-private sector joint competitions and incubators and accelerators. In most challenge programmes, the public administration body comes up with a defined problem set that they pitch to startups or established corporations who in return work on this problem and present their innovative solution. The winning agency will then be offered a price fund or be contracted in return. Government challenge programmes are not only carried out on the federal level but can range in size and length. As both France and Germany drive forward government challenge programmes, the country analysis will include a case study of one challenge programme each to see how the respective governments include startups in solving common public sector obstacles.

Another factor that impacts the relationship of the collaboration between government and startups is the institutional and political context of a country. This includes procurement laws and regulation but also the overall public sector culture and organisation. A crucial difference between France and Germany’s GovTech strategies is the level of centralisation, with France being much more centralised and Germany being federally organised.

As a first step, we will shed a light on the French GovTech strategy.

France

Considering relational factors, the French GovTech landscape can be split into six actors: 1) entrepreneurs and startups, 2) investors/funders, 3) incubators and accelerators, 4) civil society, 5) consultants and lastly 6) government.

In the field of government, one of the most important public agents is the DINUM, the Inter-ministerial Directorate for Digital Services, that was created in 2019. Its task is to coordinate all activities of the French government in the area of information systems. Moreover, the DINUM supports all ministries with regards to their digital transformation. The French Government launched its strategy for GovTech in April 2019, creating a programme called Tech.Gouv which is led by the DINUM and aims to help digitise public services. The strategy defines six main priorities: 1) attractiveness, 2) alliances, 3) command, 4) economies, 5) inclusion and 6) simplification. A roadmap for the years 2019-2022 was launched alongside the strategy, which maps out the accomplishment of eight over-arching missions. Four missions are centred on identifying new-use cases for digital services and the other four missions are centred on the acceleration of existing public services. These eight missions relate to 35 prioritised projects that were scheduled to launch between 2019-2022.

An important tool offered by the DINUM is the “Catalogue Tech.Gouv”, an online catalogue which displays the 768 French GovTech solutions that have been developed so far (as of 20 October 2022). By collecting all offerings on one website, the catalogue aims to encourage public sector officials to use digital tools and GovTech solutions that can be useful to them, whether they originate from companies or associations.

Furthermore, several policy initiatives aimed at establishing a GovTech ecosystem have been put in place. The most prominent example is Beta.gouv, a programme which brought forward multiple state-startups, evidencing a G2G rather than B2G approach. A state-startup as in the French model is launched via the beta.gouv mission and matches a team and a problem definition that they can work on. They receive no funding and the startups are no separate juridical entity, the owner of the idea and startup really is the French state. To support this mission, the beta.gouv programme launched 16 incubators which are now hosted by French ministries. Beta.gouv was launched in 2013 by the predecessor of the DINUM, with the aim to create state-startups that would be beneficial to the French society. The detailed functioning of beta.gouv is explained in this blogpost.

The DINUM is committed to advancing GovTech uptake and has built multiple streams next to beta.gouv to drive the topic. The larger GovTech strategy and action plan for 2019-2022 is in place and, according to evaluations at the halfway point of the programme, it is running very successfully. One and a half years after its launch, all the planned projects have been launched and most have achieved results in line with or even better than the initial objectives. According to the French government, the current COVID-19 crisis has highlighted the importance and potential of GovTech and served as a catalyst to further drive the digitalisation of public services. In addition, the GovTech catalogue is an important tool to showcase which solutions have already been developed and helps the public sector to get in touch with startups more easily.

Considering the institutional and political context, it is important to note that France has been organised in a decentralised state system since 1958 yet it is still one of the most centralised states in Europe. The federal state remains strong and culturally the idea persists that the capital Paris rules over the entire country. The French public sector and administrative system are perceived as capable and powerful, which is in stark contrast to the public sector in other countries. This is crucial when speaking about the collaboration of GovTech startups and the public sector and is also reflected in the set-up of the beta.gouv programme as the startups are owned by the government itself. France deliberately chose this approach, but it is important to note that this cannot be blindly transferred to other countries as the relational factors and institutional and political context is different.

To conclude, France has created around 367 state-startups in nine years of supporting GovTech projects, but not all of them have been viable. 25 have been scaled to a national level and can be counted as functioning startups. Whether this number can be seen as a success or not depends on the perspective of the beholder. Yet, a clear success is that the state-startups are well integrated into the overall GovTech landscape, and the programme brings forward a multitude of well-known and frequently used digital services to the French public. The French government is committed to advancing GovTech matters and pursues multiple streams next to creating state-startups that contribute to a well-functioning GovTech strategy.

Teaser image by Eddie Junior on Unsplash.